The rental market in Canada has seen a shift in recent years, and the trends outlined in the 2022 Rental Market Report from Canada Mortgage and Housing Corporation (CMHC) provide insight into the current state of the market.

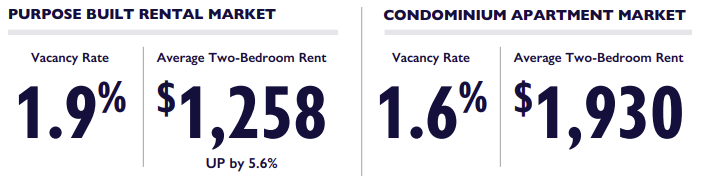

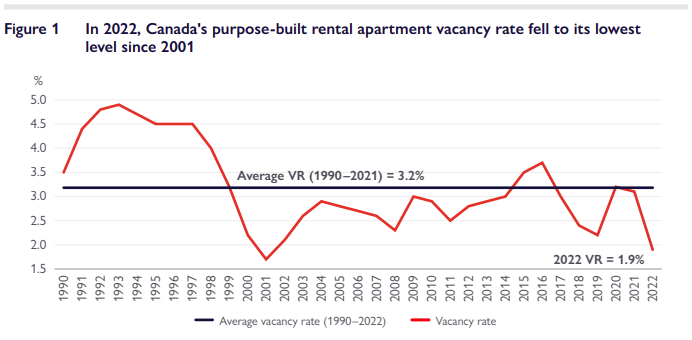

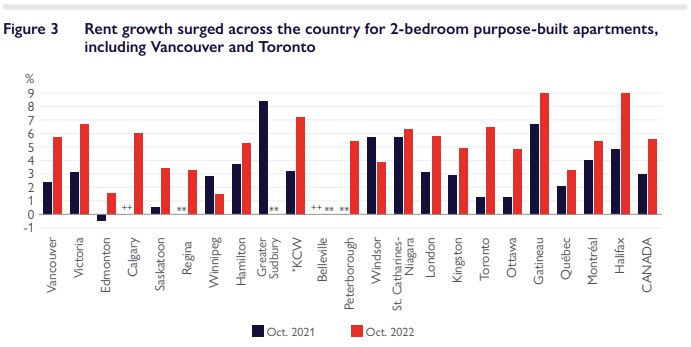

According to the report, the rental market in Canada is experiencing low vacancy rates, which is putting pressure on rental prices and making it difficult for renters to find affordable housing. In the country’s largest cities, including Toronto, Vancouver, and Montreal, vacancy rates are even lower, hovering around 1%. This high demand for rental properties is driving up rental prices, with the average rent for a two-bedroom apartment increasing by 5% from 2021 to 2022.

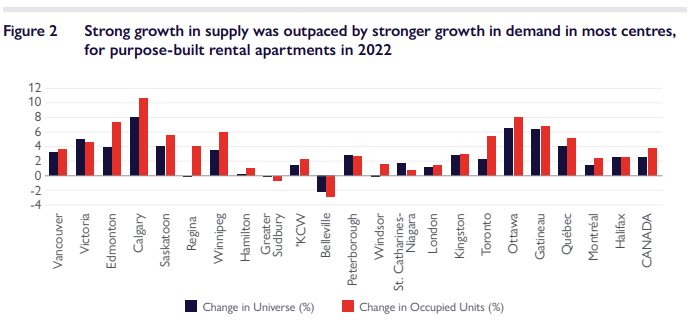

The report also highlights the importance of purpose-built rental apartments in meeting the growing demand for rental housing. In 2022, the construction of new rental apartments increased, but more was needed to keep up with the growing demand, which resulted in low vacancy rates and higher rental prices.

The current economic climate also impacts the rental market, with the COVID-19 pandemic causing uncertainty for renters and landlords alike. The report notes that the pandemic has resulted in job losses and reduced income for many renters, making it difficult for them to afford increasing rental prices. Additionally, the pandemic has caused a decrease in immigration, which has led to a reduction in demand for rental housing in some markets.

In conclusion, the rental market in Canada is facing several challenges, including low vacancy rates, high rental prices, and the impact of the COVID-19 pandemic. However, purpose-built rental apartments remain an essential solution to meeting the growing demand for rental housing. The rental market will likely become more stable as the economy continues to recover. Investors and property owners should keep an eye on these trends and be prepared to adapt to changes in the market as necessary.

If you would like to get the full copy of the report, please fill out the form below: