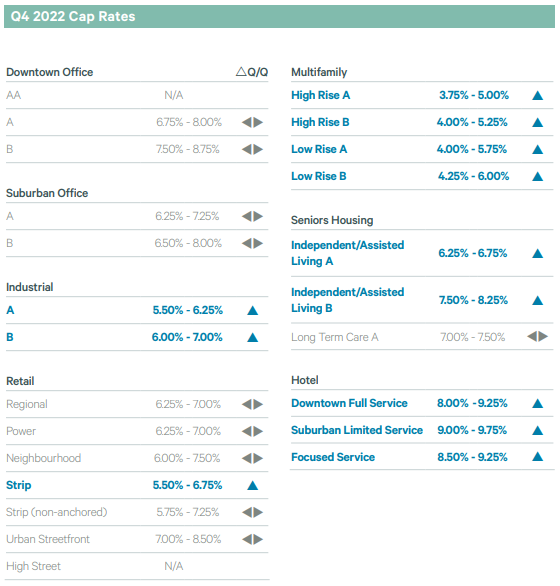

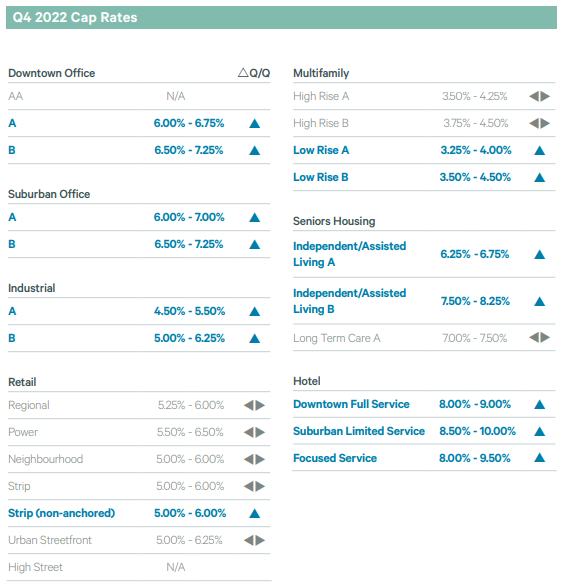

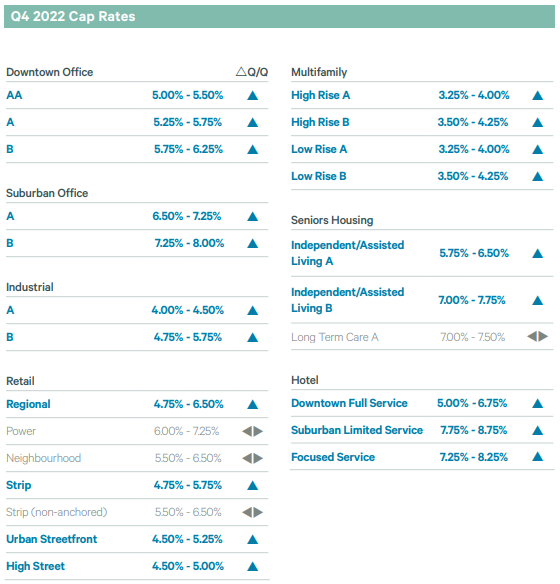

According to the CBRE’s Q4 2022 Canadian Cap Rate Report, the multifamily market in Ontario has seen a steady incline in cap rates over the past year. The report states that cap rates for multifamily properties in Ontario have changed to an average of 4.25%, with a range of 4.0-4.5%.

This change in cap rates can be attributed to a number of factors, including steady demand for rental properties and a shortage of available units in the market. Additionally, rising interest rates have made it difficult for some investors to qualify to purchase multifamily properties, further changing cap rates.

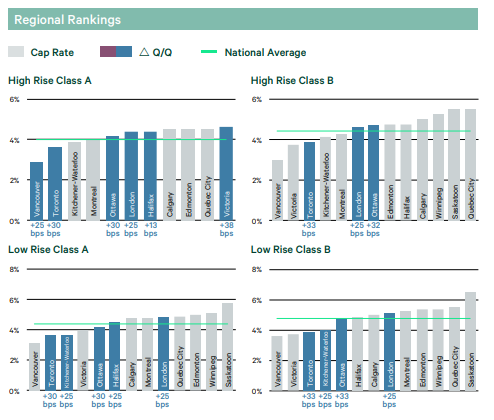

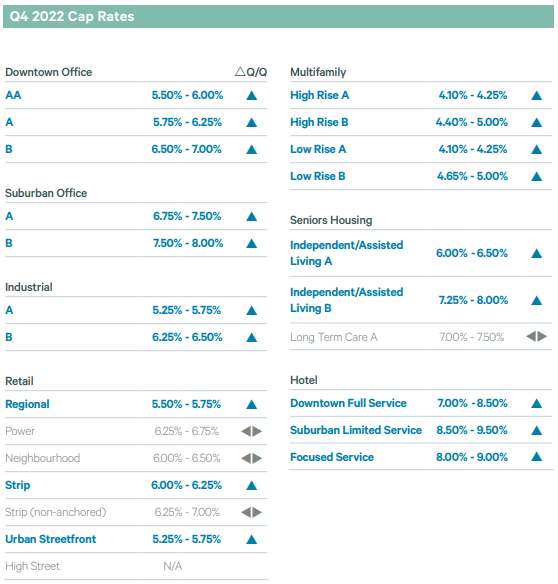

Following are some important multi-family graphs worth noting:

Despite the incline in cap rates, investors are still finding value in the Ontario multifamily market. The report notes that the province’s strong economy and population growth continue to make it a desirable location for multifamily investment.

It’s worth noting that cap rates can vary between different regions in Ontario, for example, cap rates in Toronto are lower than the average in Ontario. Therefore, it’s always recommended to research the specific area you are interested in.

In conclusion, the multifamily market in Ontario remains a strong investment opportunity for those looking for steady cash flow and long-term appreciation. If you’re interested in getting a copy of the report or interested in investing in real estate, feel free to fill out the form below to get a link to the report and connect with us.