Investing in real estate can be a rewarding venture, but it comes with its own jargon that can confuse beginners. One such term you’ll often encounter is “Cap Rate.” But what exactly is the Cap Rate, and why is it crucial for investors? Let’s break it down in simple terms.

A Cap Rate is short for Capitalization Rate, a fundamental metric used in real estate to evaluate a property’s potential return on investment. In simpler terms, it’s a way to measure the profitability of a real estate investment.

The Cap Rate is a percentage that indicates the potential return on an investment. A higher Cap Rate generally suggests a higher potential return but may also come with higher risk. Conversely, a lower Cap Rate may indicate a safer investment with lower returns.

Cap rate is calculated using a straightforward formula, it is equal to Net Operating Income (NOI) divided by the current market value of the asset. (see the photo below for the graphic illustration)

A situational example:

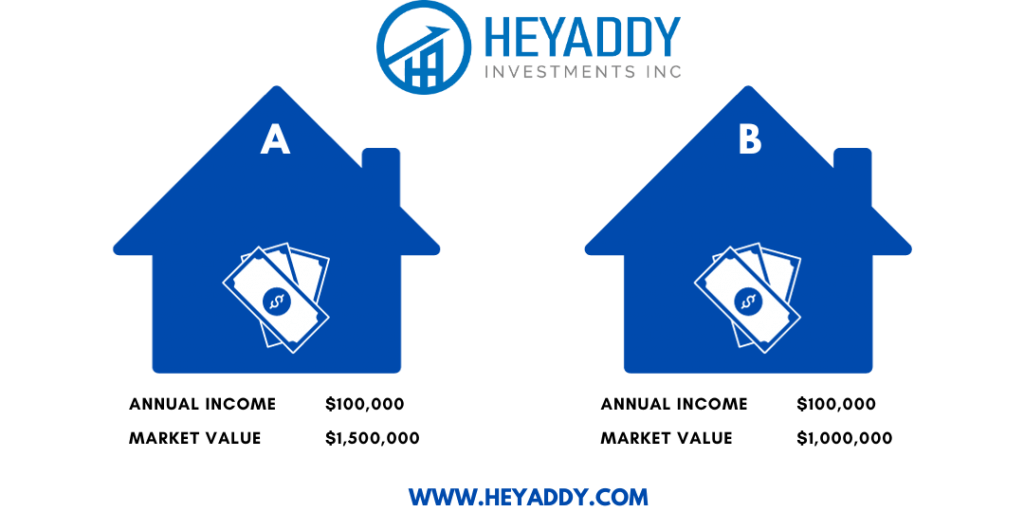

Addy is an investor looking to buy an investment property. From taking real estate courses, he remembers that the capitalization rate is an effective metric in evaluating real estate properties. Addy identifies and compares two properties with their annual income and market values:

After calculating the properties’ cap rates, Addy realizes that Property B has the highest cap rate of 10%.

Addy may base his purchase on the rate alone in a straightforward scenario. However, it is just one of many metrics that can be used to assess the return on commercial real estate property. While it provides a good estimate of a property’s potential return, it’s not the only metric to consider. In fact, various other metrics like the gross rent multiplier, internal rate of return, debt coverage ratio and many more should also be considered. So, when assessing a real estate opportunity, it’s wise to consider a combination of these metrics, not just the Cap Rate, to get a more comprehensive picture of its attractiveness.

Terminologies explained:

- Net Operating Income (NOI): This is the total income generated by a property minus the operating expenses. It includes rental income but excludes mortgage payments and income taxes.

- Current Market Value or Acquisition Cost: This represents the property’s current value or the cost at which it was acquired.

While Cap Rate provides a quick snapshot of a property’s potential return, it does have limitations. It doesn’t consider financing costs, future capital expenditures, or changes in property value over time. Investors should use the Cap Rate alongside other metrics for a comprehensive analysis.

In conclusion, Cap Rate is a valuable tool for real estate investors, offering a quick assessment of a property’s potential return on investment. However, it’s crucial to consider it in conjunction with other factors to make well-informed investment decisions. Whether you’re a seasoned investor or a novice exploring real estate, understanding Cap Rate is a key step in navigating the world of property investment.